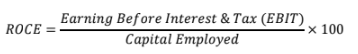

1. ROCE :-

- Capital Employed = Shareholders’ Fund + Long Term Debt

- ROCE should always be higher than the rate at which the company borrows. • ROCE ratio can assist in determining how successfully an entity generates profits from its Capital Employed when it is used.

- This explains that how much Profit (Earning) of the entity is available for Shareholders and Long-Term Borrowers (Loan, Debentures, etc.)

- Ideal ROCE for Business Loan should be more than Its Interest Rate on Borrowings.

2. DEBT / EQUITY RATIO :-

- The Formula explains that how much of entity’s Total Assets are financed by Long Term Debt.

- High Debt Equity = High Risk Entity = High Returns

- Low Debt Equity = Low Risk Entity = Low Returns

- Ideal Debt Equity Ratio for Business Loan is Less than 3.

3. TOTAL OUTSIDE LIABILITY TO TOTAL NET WORTH RATIO

(TOL/TNW):-

- TOL/TNW is a measure of a company’s financial leverage calculated by dividing the total liabilities of the company by the total net worth of the business. • This ratio gives an accurate picture of the entity’s reliance on debt. • High TOL/TNW = High Risk Entity = High Returns

- Low TOL/TNW = Low Risk Entity = Low Returns

- Ideal Debt Equity Ratio for Business Loan is Less than 5.

4. CURRENT RATIO :-

- Current Asset = Inventories + Sundry Debtors + Cash and Bank Balances + Receivables/ Accruals + Loans and Advances + Disposable Investments + Any other current assets.

- Current Liabilities = Creditors for goods and services + Short-Term Loans + Bank Overdraft + Cash Credit + Outstanding Expenses + Provision for Taxation + Proposed Dividend + Unclaimed Dividend + Any other current liabilities.

- Current Ratio is a liquidity ratio that measures an entity’s Ability to pay short-term obligations or those due within One Year.

- The current ratio helps investors understand more about a entity’s ability to cover its short-term debt with its current assets.

- Ideal Current Ratio for Business Loan is more than 1.33